The Fed’s interest rate decisions impact mortgages, but the relationship isn’t straightforward.

If you tracked the Federal Reserve’s monetary policy decisions last year, you might have been puzzled: The Fed’s three interest rate cuts didn’t bring about lower mortgage rates. In fact, the average rate for a 30-year fixed home loan has hovered around 6.8% for the past several months.

The Fed’s interest rate decisions don’t have a direct or immediate effect on home loan rates. Often, what the central bank says about its future plans can move the market more than its actual rate changes.

On Wednesday, the Fed is expected to hold off on cutting interest rates for the fifth time this year. While mortgage rates might see some ups and downs, many economists think they’ll stay pretty much the same — between 6.5% and 7% — until the economic outlook is clearer.

“Prospective homebuyers should know markets are forward-looking, and changes in mortgage rates can happen well in advance if markets can anticipate it,” said Kara Ng, senior economist at Zillow. “While a July cut is unlikely, markets are closely watching for signals about a possible September reduction,” Ng said.

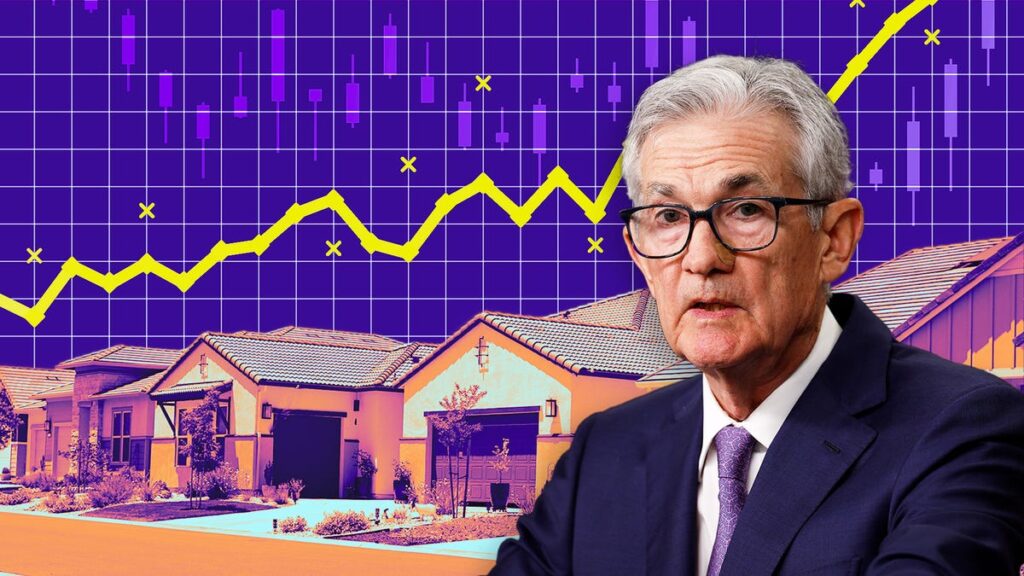

All eyes will be on Fed Chair Jerome Powell’s post-meeting remarks. If Powell signals concerns about lingering inflation or the chance of fewer cuts, bond yields and mortgage rates are likely to climb. If he expresses optimism about inflation being under control and hints at ongoing policy easing, mortgage rates could dip.

Here’s what you need to know about how the government’s interest rate policy influences your home loan.

What is the Federal Reserve’s relationship to mortgage rates?

The Fed sets and oversees US monetary policy under a dual mandate to maintain price stability and maximum employment. It does this largely by adjusting the federal funds rate, the rate at which banks borrow and lend their money.

When the economy weakens and unemployment rises, the Fed lowers interest rates to encourage spending and propel growth, as it did during the COVID-19 pandemic.

It does the opposite when inflation is high. For example, the Fed raised its benchmark interest rate by more than five percentage points between early 2022 and mid-2023, to slow price growth by curbing consumer borrowing and spending.

Changes in the cost of borrowing set off a slow chain reaction that eventually affects mortgage rates and the housing market, as banks pass along the Fed’s rate hikes or cuts to consumers through longer-term loans, including home loans.

Yet, because mortgage rates respond to several economic factors, it’s not uncommon for the federal funds rate and mortgage rates to move in different directions for some time.

Why is the Fed postponing interest rate cuts?

After making three interest rate cuts in 2024, the Fed has been in a holding pattern throughout 2025. President Trump’s unpredictable tariff campaign, immigration policies and federal cutbacks threaten to drive up prices and drag on growth.

Despite the president’s repeated calls for policymakers to cut borrowing rates immediately, economists say the central bank has good reason to pause.

“Cutting rates prematurely — especially in response to political pressure — could undermine its commitment to controlling inflation,” said Ng. ” Ironically, this could cause mortgage rates to rise, not fall, counteracting the intended stimulus.”

Lowering interest rates could allow inflation to surge, which is bad for mortgage rates. Keeping rates high, however, increases the risk of a job-loss recession that would cause widespread financial hardship.

Recent data show inflation making slow but steady progress toward the Fed’s annual target rate of 2%, but price growth is expected to tick back up in the coming months as companies pass on the cost of tariffs onto consumers.

What is the forecast for Fed cuts and mortgage rates in 2025?

While experts now predict an interest rate cut in the fall, Fed Chair Powell remains noncommittal on any specific timeframe.

Inflation could prompt the central bank to forgo one (or both) of its projected rate cuts, which would keep mortgage rates high.

On the flip side, if unemployment spikes — a real possibility given the slowdown in hiring and the uptick in layoffs — the Fed could be forced to implement interest rate cuts. In that case, mortgage rates should gradually ease, though not dramatically.

Most housing market forecasts, which already factor in at least two 0.25% Fed cuts, call for 30-year mortgage rates to stay above 6% throughout 2025.

What factors affect mortgage rates?

Mortgage rates move around for many of the same reasons home prices do: supply, demand, inflation and even the employment rate.

Personal factors, such as a homebuyer’s credit score, down payment and home loan amount, also determine one’s individual mortgage rate. Different loan types and terms also have varying interest rates.

Policy changes: When the Fed adjusts the federal funds rate, it affects many aspects of the economy, including mortgage rates. The federal funds rate affects how much it costs banks to borrow money, which in turn affects what banks charge consumers to make a profit.

Inflation: Generally, when inflation is high, mortgage rates tend to be high. Because inflation chips away at purchasing power, lenders set higher interest rates on loans to make up for that loss and ensure a profit.

Supply and demand: When demand for mortgages is high, lenders tend to raise interest rates. This is because they have only so much capital to lend in the form of home loans. Conversely, when demand for mortgages is low, lenders tend to slash interest rates to attract borrowers.

Bond market activity: Mortgage lenders peg fixed interest rates, like fixed-rate mortgages, to bond rates. Mortgage bonds, also called mortgage-backed securities, are bundles of mortgages sold to investors and are closely tied to the 10-year Treasury. When bond interest rates are high, the bond has less value on the market where investors buy and sell securities, causing mortgage interest rates to go up.

Other key indicators: Employment patterns and other aspects of the economy that affect investor confidence and consumer spending and borrowing also influence mortgage rates. For instance, a strong jobs report and a robust economy could indicate greater demand for housing, which can put upward pressure on mortgage rates. When the economy slows and unemployment is high, mortgage rates tend to be lower.

Read more: Fact Check: Trump Doesn’t Have the Power to Force Lower Interest Rates

Is now a good time to get a mortgage?

Even though timing is everything in the mortgage market, you can’t control what the Fed does. “Forecasting interest rates is nearly impossible in today’s market,” said Ali Wolf, Zonda and NewHomeSource chief economist.

Regardless of the economy, the most important thing when shopping for a mortgage is to make sure you can comfortably afford your monthly payments.